Turn Checking Accounts into Your Competitive Advantage

Recover lost fee income, differentiate offerings, and deliver value that keeps clients loyal with Flourish Checking powered by GenGold.

The Banking World Has Shifted

We understand the new pressures your community financial institution is facing.

Increased

Regulatory Pressures

Regulatory changes have slashed NSF/OD fee income, leaving you with budget shortfalls and the need to find new revenue sources to stay financially stable.

Checking Commoditization

With checking accounts becoming more commoditized, it’s harder than ever for you to stand out, attract new clients, and deepen relationships with existing ones.

The Allure

of Online Banks

As digital-only banks and credit unions pull clients away with convenience and competitive rates, keeping your community engaged is more challenging than ever.

Flourish Checking Drives Opportunity + Loyalty

Flourish Checking helps you turn your modern-day banking challenges into opportunities for growth, by delivering real value to your members.

Recover Lost Fee Income

Recoup significant revenue shortfalls with a dynamic solution that helps your institution generate fee income and still benefits your clients.

Attract New Clients

Stand out from your competitors (around the corner and online) by offering unique, everyday savings and benefits that clients can’t find anywhere else.

Improve Client Retention

Keep clients loyal and deepen relationships by providing real, tangible value—far beyond what they expect from a traditional checking account.

Flourish Checking Drives Opportunity + Loyalty

Flourish Checking helps you turn your modern-day banking challenges into opportunities for growth, by delivering real value to your members.

Real Savings

Identity Protection

Ease of Integration

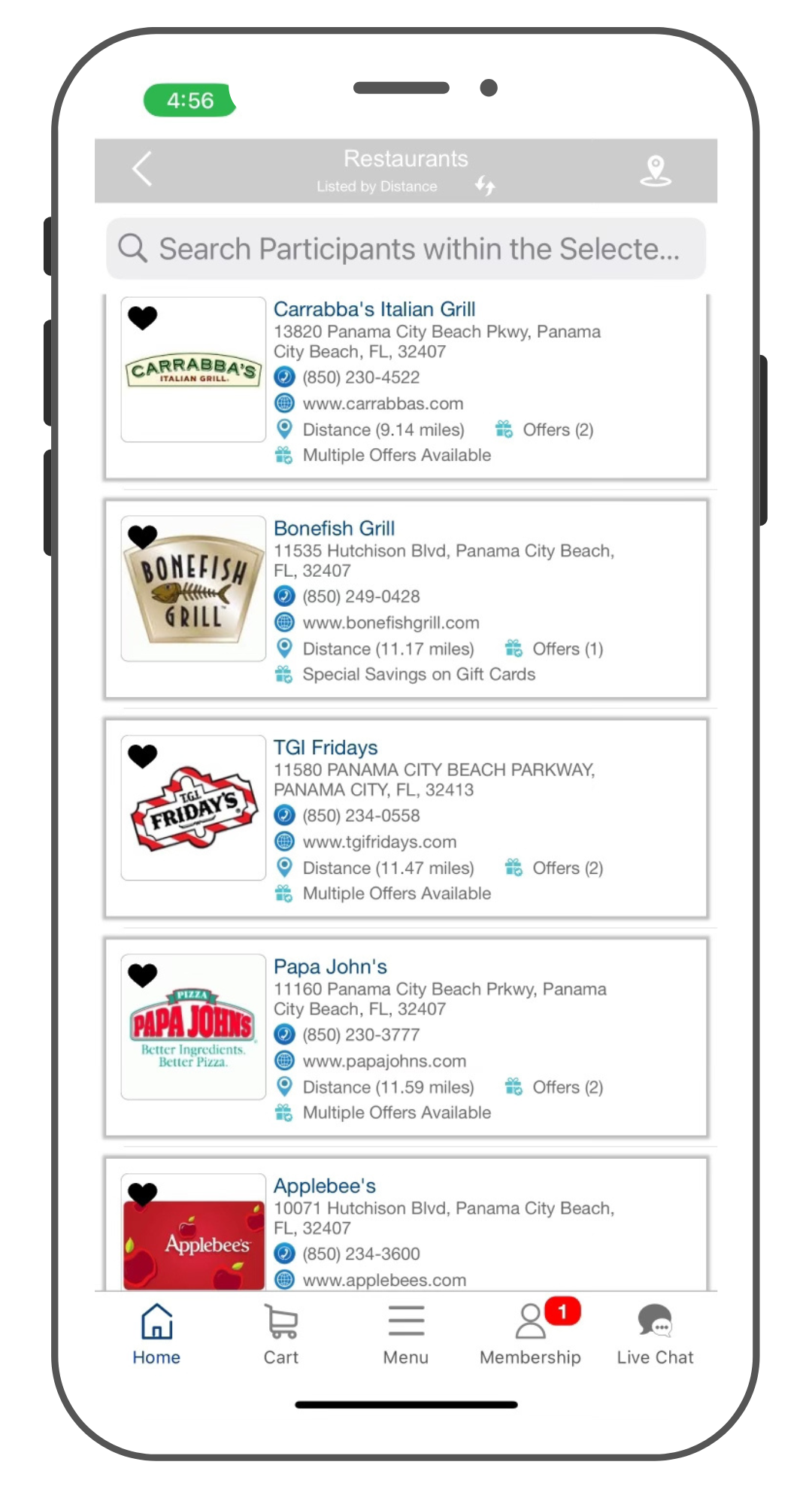

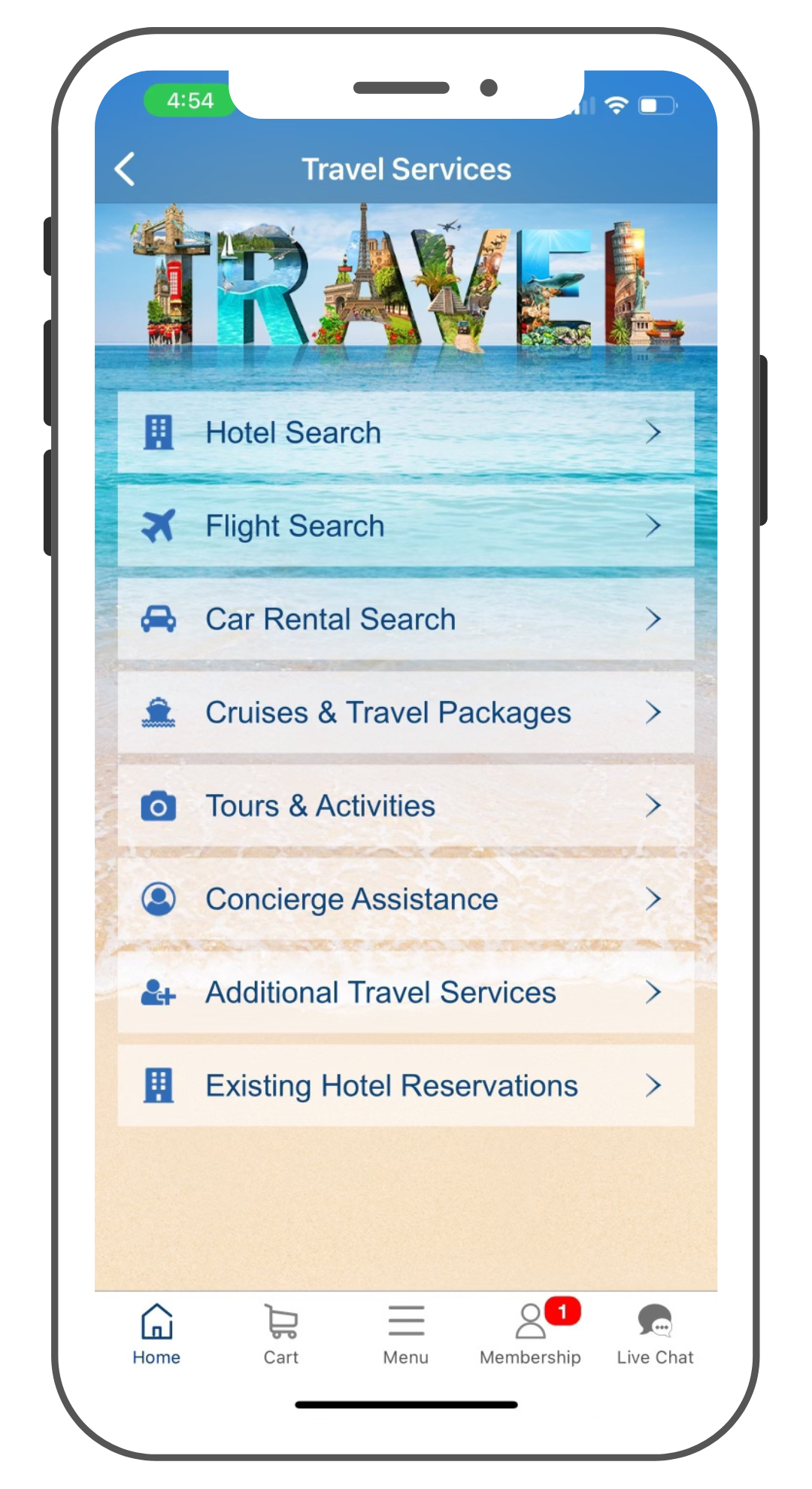

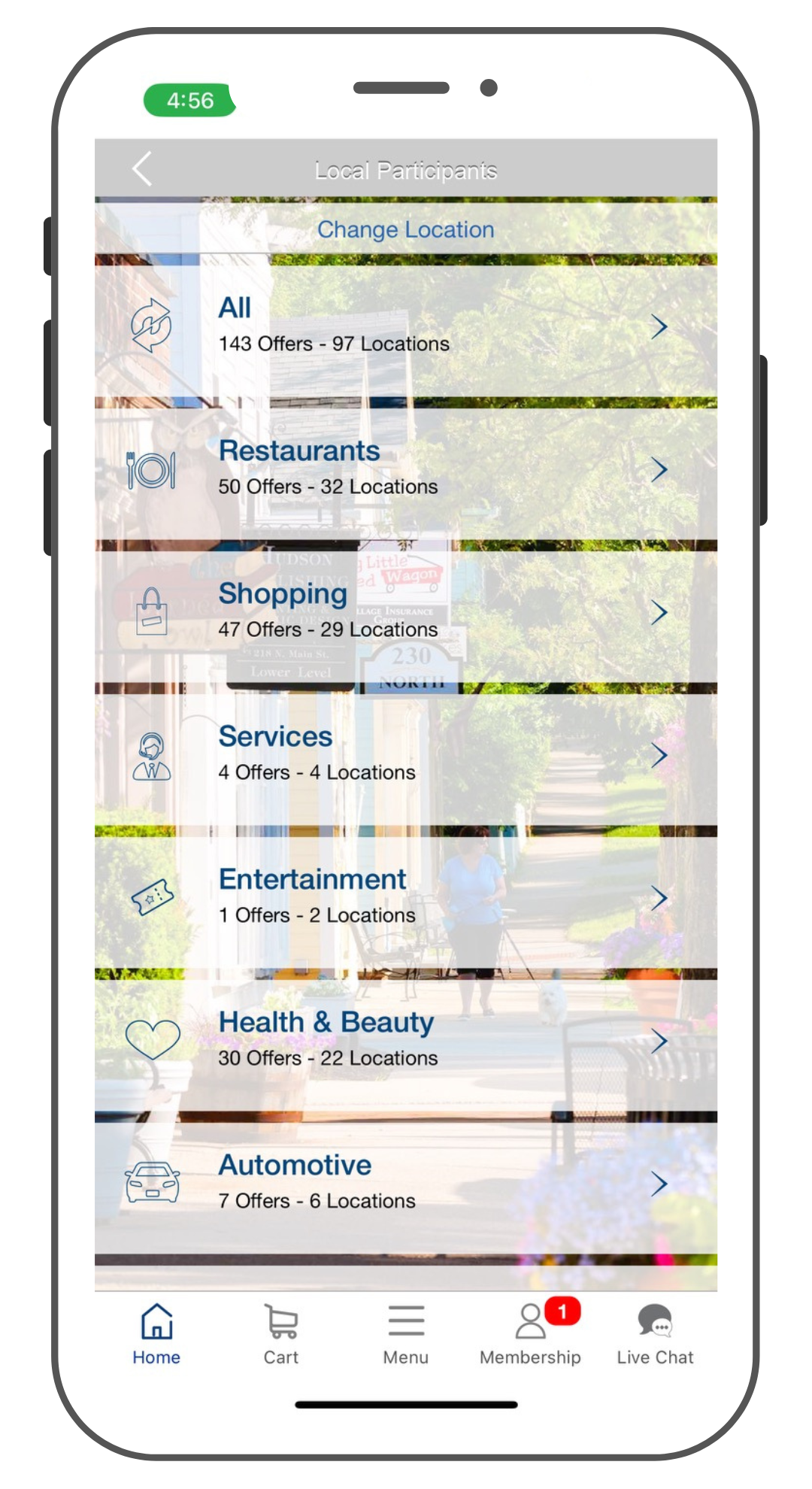

Seamlessly integrate Flourish Checking into your existing digital platforms, or utilize a standalone white labeled application.

Employee Benefits

Tailored Packages

What Flourish Checking Users Have to Say

“We are earning quite a bit of fee income on these — $88,000 per month — I ran a few report comparisons between regular Checking and CP and found that the CP members are more engaged which means they have a higher percentage of Mobile, Direct Deposit, Online Banking usage and Debit Pin transactions by capita. So, a Benefits Plus member is more engaged than a free Checking member. Currently we have 28% of our total Checking households enrolled."

“The program currently nets nearly $60,000 per month and it’s growing in net interest income month over month. We’ve just launched Ultimate with projections of an additional $400,000 by 2023. This program puts members on your books who are never going to leave because of the real value and commitment to concierge service. The member testimonials are amazing!”

“As of January 31, 2022, we have 7,771 enrollments, which is a new record! Currently the program accounts for 31% of all checking accounts. The 2022 income was more than $950,000!”